What is Cryptocurrency Mining?

Mining is the process in which a host machine will communicate with the blockchain and ledger to process, confirm, and verify transactions.

Groups of these miner’s act as the backbone to any given cryptocurrency.

When a miner is working on processing transactions they are given payouts as incentive to continue to support the blockchain.

The majority of these payouts outweigh electricity costs, making it very profitable to mine cryptocurrencies.

However, a lot of the hardware required has a hefty price tag but some not so much.

Today I’m going to go over nearly everything about the mining processes of cryptocurrency, how much it costs, how much it could make, and how you can get started.

These miners all run off of different hash algorithms, so some of them cannot mine other coins unless they are the same algorithm.

Always remember payouts from miners are variable based on price, hashrate, and difficulty and expected revenue will change nearly every day.

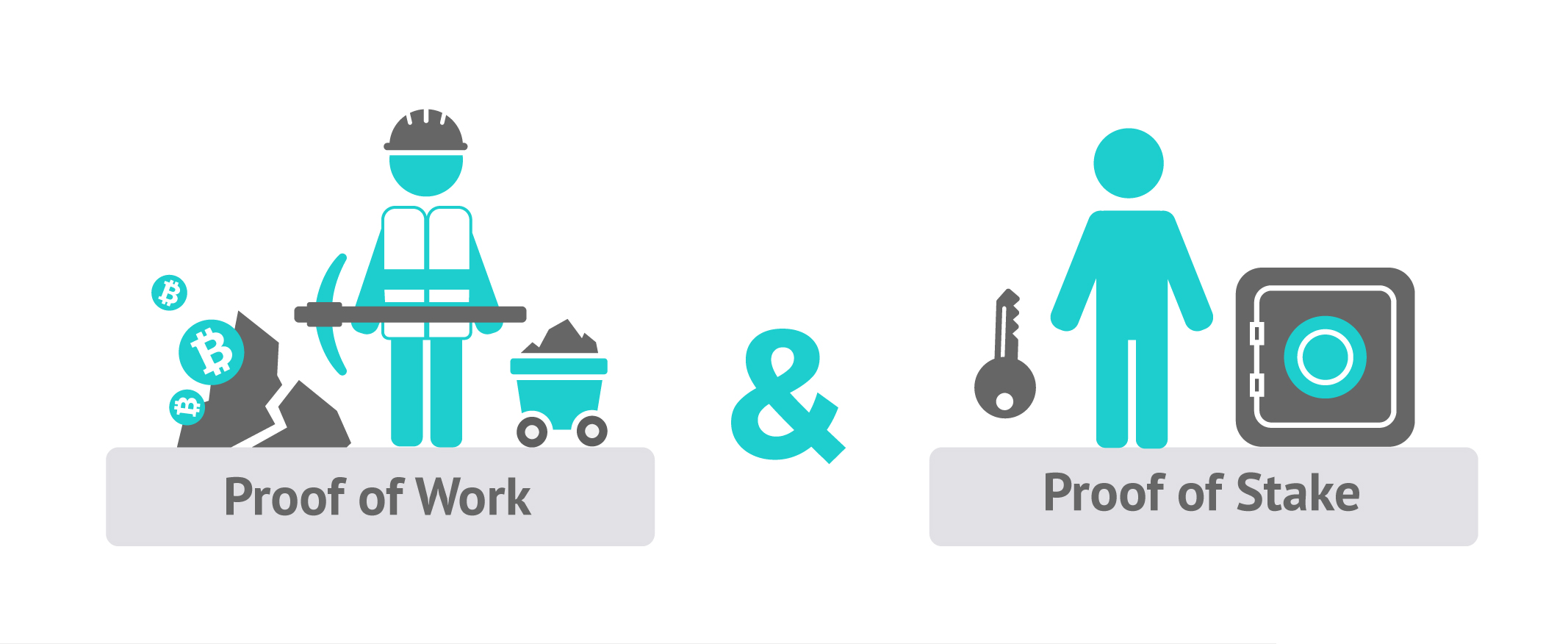

Proof of Work vs. Proof of Stake

The first thing you need to know about is the verification process of the coins, whether they’re Proof of Work (PoW) or Proof of Stake (PoS).

Proof of Work coins are where you’re going to look for mining hardware, coins such as Bitcoin, Litecoin, and Ethereum (for now) run off of a Proof of Work system which means miners do the voting and verifying on the network.

Proof of Stake coins do not run off of miners, instead you stake a certain amount of the currency on the network to prove you’re not acting maliciously, if you do, you lose your stake, that’s what keeps Proof of Stake blockchains from becoming corrupted.

Having a stake on the network will give you payouts to the wallet address almost as interest would.

Both methods are considered mining, but you’re probably more familiar with the actual miners in a Proof of Work system.

ASIC vs. GPU/CPU/RAM/HDD Mining

Application Specific Integrated Chip (ASIC) mining is a piece of hardware where the silicon chip processors on board have a single job, processing one algorithm.

While ASIC machines are incredibly good at mining their specific coins, they can not do anything else but mine and communicate to the network.

So, if for some reason it becomes unprofitable to mine, you’d be stuck with a piece of hardware that can’t do much else.

I will discuss a lot of ASIC machinery and equipment in another section of this article.

GPU Mining

Graphical Processing Unit (GPU) mining has become renown as the most popular form of mining ever since it was discovered that GPU’s are more efficient in processing the data than typical processors were.

The positive side to GPU mining is that you can switch to almost any non-ASIC coin to mine , and if mining becomes unprofitable, you still have a gaming GPU you can unload onto someone for some of your original capital back.

Ethereum is the most popular GPU mineable coin at the moment, and is very expandable in terms of adding new cards to a base system.

CPU & RAM Mining

Central Processing Unit (CPU) and Random-Access Memory (RAM) mining reside mostly in the Proof of Stake space now.

While historically used for mining Bitcoin, many far more efficient ways of mining have risen since then.

Since Proof of Stake is backed by your staking of currency, it requires less computing power to verify transactions, giving CPU and RAM miners an advantage in this case.

If you’re new to cryptocurrency mining, this is a good way to understand the history of mining.

NEO and PIVX are good examples of Proof of Stake coins that run like this.

HDD Mining

Hard Disk Drive (HDD) or Hard Drive mining is found occasionally in the mining world.

Basically, the chain uses free space in your storage to process transactions.

This form of mining is primarily used in coins that are backing some sort of storage project(s) such as BURST or STORJ.

This is a great method if you happen to have a bunch of old hard drives laying around, but I have even seen people buy entire JBOD servers with 60 hard drives for mining in this case.

GPU’s in Mining

When deciding to mine with GPU’s, it is important to know what the right one to buy is.

There are many different specification, speeds, sizes, and brands to choose from.

NVIDIA and AMD are the leading producers of GPU’s and each one is better on certain algorithms than the other is.

AMD is known to typically top the market in this aspect and is currently holding the crown with the in Ethereum mining being the most profitable form of GPU mining.

The Vega 64/56 AMD cards have proven some hashrate but produced less hashrate per dollar when compared to the RX 580.

Memory on these cards can be important as some blockchains will need to upload information to the GDDR5 memory on-board your graphic’s card.

For example, Ethereum mining requires a 4GB memory card, although I recommend 8GB cards for Ethereum, and up as the DAG file has to be running on it at all times and is currently over 3GB.

That is something to investigate when choosing card(s).

It is also necessary for you to weigh the price of certain cards with their projected outputs to know whether you approve of the Return on Investment (ROI) time.

If you plan on GPU mining you will have to learn how to build a computer, and the best way to fit a maximum amount of GPU’s on a single machine at once.

ASUS produces several motherboards that can support between 1 and 19 (Yes, 19!) GPU’s.

Putting that on an open-air case should allow you to build the most efficient GPU miner possible.

There are many online merchants that sell this kind of equipment, but I recommend knowing what you’re doing first so you don’t lose money to incompatible parts and lose time to diagnostics.

Currently Windows will only support up to 8 cards, Linux can do much more.

If you plan on using Linux and more than 8 cards ETHOS is a great pre-compiled version of Linux that will make setup quite easy.

If you do your research GPU mining can prove to be incredibly profitable.

An 8x RX 580 rig costs around $4,000 now with the inflated GPU prices, so ROI is a little over a year.

However, GPU miners run lower risks than ASICs as they can be used to switch to other coins and possibly one will be more profitable than Ethereum one day.

GPU Mining Rig Equipment

gpuShack does offer some great bundles for beginners to get started with GPU mining, while I have personally tested some of these bundles, I can agree that they are using good quality equipment at a reasonable price.

However, buying the parts separately will allow you to have up to 19 GPU’s whereas gpuShack only offers up to 13 on their boards, and do it for the same price or better.

Rack (Recommended)

There are many open-air GPU racks online for great prices, gpuShack’s is too expensive at almost $300, you can find better ones online in the $100 range.

Motherboard

ASUS B250 MINING EXPERT – This board has 19 PCI-e slots to support up to 19 GPU’s on one board.

Currently runs a price tag just around $150.

CPU and RAM

A 7th gen (LGA 1150) Celeron will due, and some cheap DDR4 RAM.

RAM requirements differ for coins, and amounts of cards, so make sure you get enough.

I’ve never seen more than 8GB be required.

Storage

Unless you plan on mining with HDD’s, I would install the operating system on a USB and boot to it as they use the lowest electricity.

USB’s can be cloned very quickly so you can just plug another in and go if yours dies.

You shouldn’t be storing any wallets on this machine, so data integrity is not important.

Power Supply

This piece is far more important than most think, you’ll need the biggest power supply and possibly two if you go over 8-9 cards.

It is critical you find quality units with Gold or better efficiency ratings to keep electricity costs low.

You’ll either need to find a dedicated mining power supply or a great modular one such as the Corsair 1000W+ series of supplies.

Accessories

You’ll need some USB 3.0/PCI-e expansion adapters (1x to 16x).

This is the only way to put GPU’s on the 1x PCI-e slots on your board.

You can find these everywhere, even on Amazon, to buy in bulk for a couple bucks.

GPU

Ethereum mining would leave the AMD RX 580 as the best GPU to use, but the nVidia 1070 is not a bad choice for mining some other cryptocurrencies as well.

Algorithms

Cryptocurrencies all use different types of algorithms to run their ledger/blockchain from.

They can only be mined using that algorithm and therefore make ASIC machines non-transferrable through platforms.

ASIC-resistant coins can be mined with any GPU or other form.

Here is a list of primary ASIC coins and their algorithms.

SHA256

The most popular cryptocurrency algorithm and also what the famous Bitcoin (BTC) runs off of.

Bitcoin Cash (BCH) can also be mined with machines running this algorithm, but is currently less profitable than Bitcoin, but could change in the future.

SHA256 is now only mined with ASIC machines, currently the most renown ASIC machine for this algorithm is the Antminer S9 manufactured and sold by Bitmain.

Bitmain has proven to be one of the most reputable sources of ASIC mining equipment since the beginning.

The Antminer S9 as of today can be bought with a power supply for just under $2000 and will pay for it’s electricity as well as create a good amount of profit as well.

I would not recommend any other manufacturers as Bitmain has the most efficient and lowest cost SHA256 miners, the others are not nearly as profitable.

Scrypt

Another generally known algorithm and what the popular Litecoin (LTC) uses.

Between the Bitmain Antminer L3+ and the Innosilicon A6 LTCMaster there are several market options for Scrypt ASIC miners.

Litecoin (LTC) has a huge following and helpful community and the creator Charlie Lee (@SatoshiLite) remains extremely active on twitter.

Scrypt is a good place to start during your ASIC endeavor.

At about $1300 this piece of equipment will give you a 6 month ROI paying out about 1.3 LTC a month.

X11

Popular and controversial X11 is a notorious algorithm primarily used by DASH.

The reason it gained notoriety is due to it’s difficulty inflation several months ago.

When Innosilicon produced a 38GH/s X11 ASIC miner, at the time unheard of, a lot of people began mining all at once blowing up the difficulty making it not as profitable to mine.

Those same machines have gone down exponentially in price in order to restore balance and make mining X11 profitable again.

This ASIC is around $500 and has an ROI around 9 months.

Outputting about 0.2 DASH a month, the Antminer D3 is currently the only DASH ASIC that makes ROI in less than a year, the rest remain much longer.

Blake(2b)

While recently gaining traction in the cryptocurrency world, Blake(2b) is known to mine SiaCoin (SC).

It seems very profitable to buy the new ASIC’s to mine this algorithm, but the difficulty is slowly rising as it is a new piece of technology added to the realm.

I would keep my eye on this one, and maybe get one miner to see if it remains incredibly profitable.

Currently you make about 200% of what it costs in electricity monthly, but the machine is sitting at a $1,000 price tag.

The miner will output around 22,000 SiaCoin at 815GH/s monthly, putting ROI around 5 months.

CryptoNight

As of now, CryptoNight is brand new to the ASIC world and used to mine said cryptocurrencies.

Now, this algorithm wasn’t supposed to be mined with ASIC machines, but recently has.

This will likely increase the block difficulty lowering average payouts from mining in this algorithm.

I plan on watching these miners and profitability in the future.

Monero (XMR) is a renown CryptoNight coin but will be forking and will not be possible to mine with these ASIC machines.

Electricity & Costs

It’s important that you pay attention to the cost of running the miners if you wish to remain profitable.

You’ll need to weigh the hardware costs initially as well as utility, by utility I mean the cost you hold for having these run in your house making noise and looking bad.

If you run them in their own building, you’ll have to include rent as well.

Once that is figured out, electricity is the next thing you’ll have to worry about.

The average price of electricity in the United States is about $0.12/kWh.

If you fall at or below that average, most mining is very profitable, but if you’re above the average, I recommend looking into another method of mining and investing, potentially Proof of Stake mining.

Here are some average (@ $0.12/kWh) ASIC electricity costs and revenue:

| Miner | Cost in Electricity/mo |

Revenue/mo (at time of this article) |

|---|---|---|

| SHA256 S9 Miner | $114 | $262 |

| Scrypt L3+ Miner | $70 | $221 |

| X11 D3 Miner | $85 | $80 |

| Blake(2b) A3 Miner | $112 | $235 |

Our Recommendations

If you’re new to mining and looking for a good place to start, I recommend GPU mining.

You only need one card to start and a desktop computer to put the card in.

This requires little capital, little risk, and is quite easy to learn.

ASIC miners require a little more attention, cost more, and of course serve only one purpose.

While they make more in profits typically, I would learn the skill of the trade prior to getting indulged in ASIC miners.

Conclusion

Mining is fun to get into, can pay for itself, or even pay your bills.

If you do it the right way and make informed and educated decisions on the hardware to purchase, you can run a little cryptocurrency mining facility right in your spare bedroom.

It’s also a great way to become a little more tech-savvy if you weren’t already.

Most of the profit scalability is subject to the variables at the time and why I didn’t give any profit predictions in this article.

As I said before, mining almost always pays for itself though and in my years doing it haven’t seen any miners that don’t at least pay for the electricity they consume.

Accumulate coins and happy mining!

Wanna buy snacks for my dogs?

BTC – 1K3GsVLnRR49Hpt5VBFVVKasKuFAbnuLS5

LTC – LhqmMLT8pXb3Xn8D29HDhdFkDHvittHP39

ETH – 0x6f2e8022Cf20C97FE93EbD6fBaBFf856232E4F14